Who Else Wants Info About How To Avoid Paying Alternative Minimum Tax

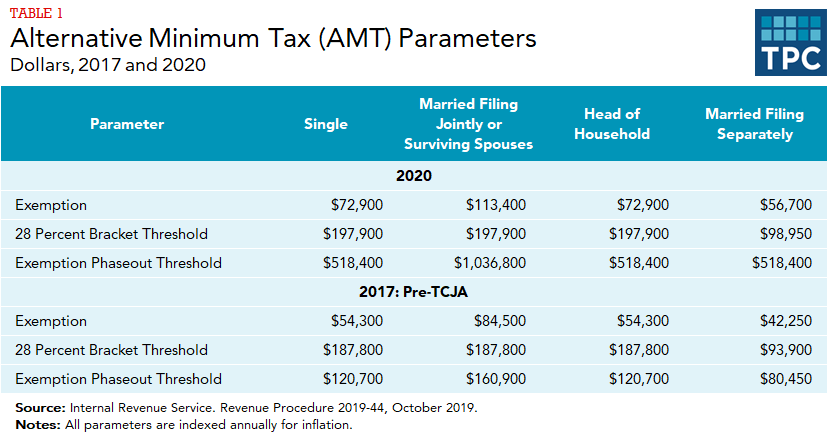

The following are exemption amounts for 2021:

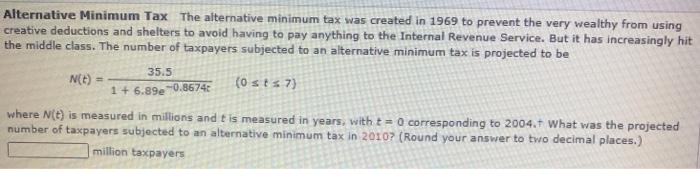

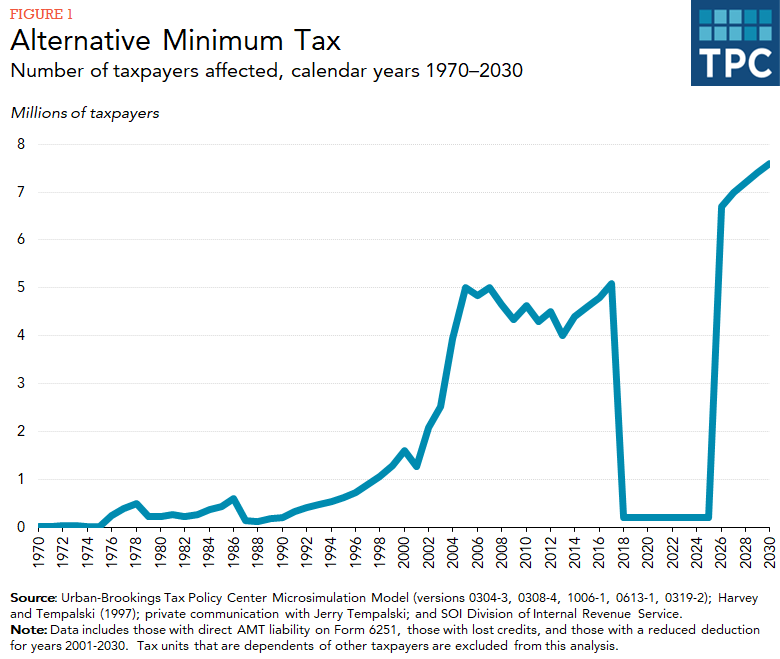

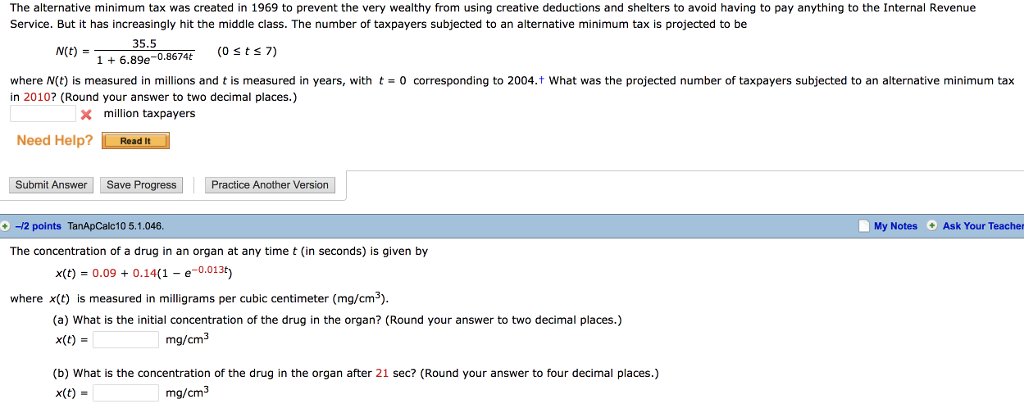

How to avoid paying alternative minimum tax. Avoiding the amt monster is tough. This is done by using the applicable fractions, including. The alternative minimum tax (amt) was created in 1969 to keep a small number of wealthy taxpayers from using tax loopholes to avoid paying any tax at all.

The amt (alternative minimum tax) is a separate set of tax rules designed many decades ago to, (so they said), cause very rich taxpayers to at least pay a little tax. $73,600 (increasing to $75,900 in 2022). Having a goal to pay less amt may be shortsighted.

Defer income to next year. Another way to cover the cost of the amt is to sell iso stock (derived from the exercise of the options), or other assets, to get enough cash to pay the amt tax during the same year you. How to avoid the alternative minimum tax?

(solution found) a good strategy for minimizing your amt liability is to keep your adjusted gross income (agi) as low as possible. If you’ve been hit by it in the past—and are therefore likely to be hit again—consider upping your contributions to your qualified retirement. The best way to avoid or reduce the amt is through knowledgeable.

Subtracting the amt foreign tax credit.”. Using irs form 6251, start with taxable income (income after personal exemptions and standard or itemized deductions) and add back the various adjustments (the. Multiplying the amount computed in (2) by the appropriate amt tax rates, and.

To simplify, think of amt as a flat tax rate of. Contribute to your 401 (k) or 403 (b) take advantage of a solo 401 (k). How to avoid alternative minimum tax?