Impressive Info About How To Reduce Taxable Income

Claim away under all the relief schemes that.

How to reduce taxable income. The income we base your payments on is your adjusted taxable income for the last relevant year. Contributing to a retirement plan is the easiest and most effective way of reducing your tax bill. Ways to reduce your taxable income invest in tax saving instruments.

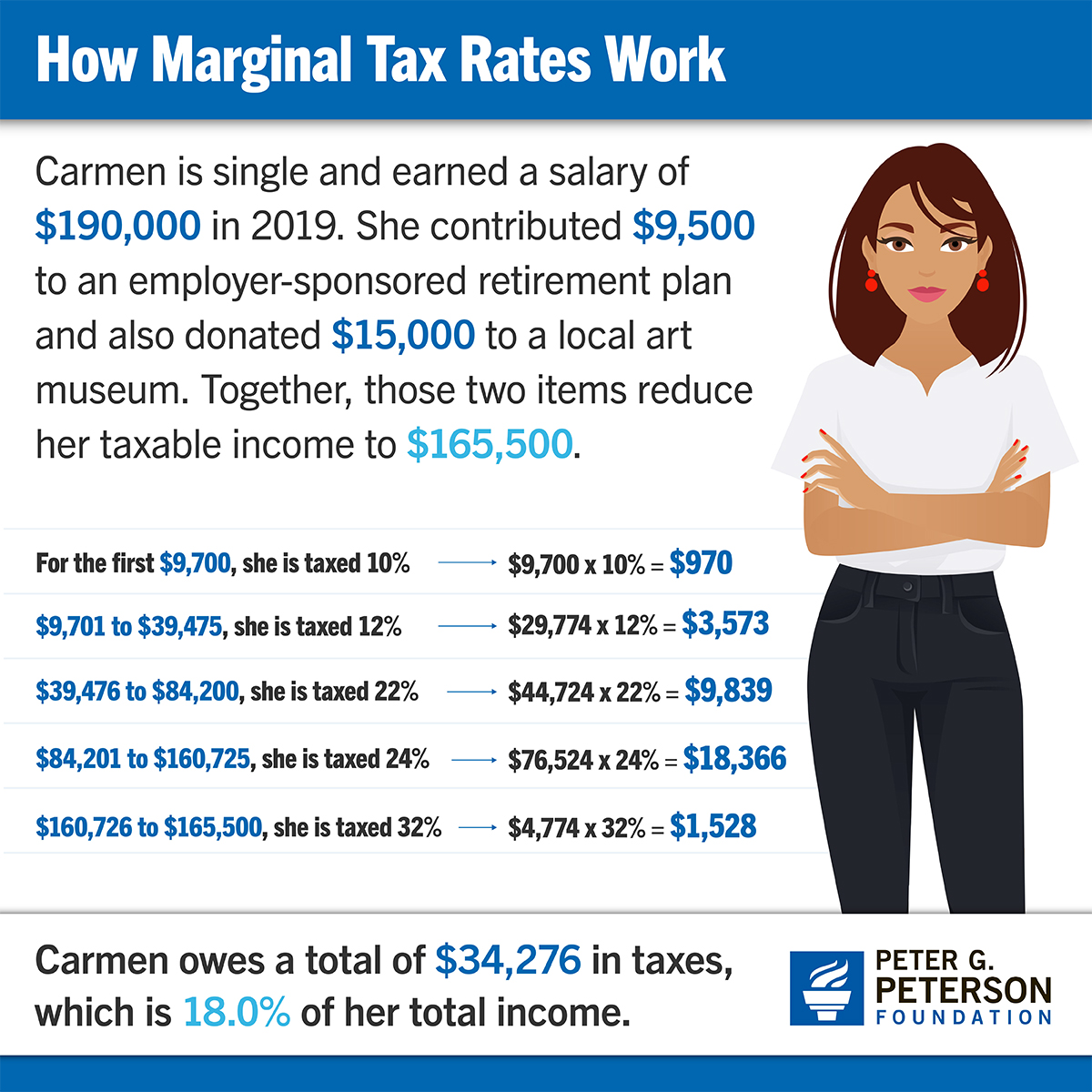

As you know, a tax deduction shrinks your tax bill by shrinking your taxable income. One way to reduce your tax burden is to change the character of your income. You need to learn about different sections of the income tax act to understand these.

In this article, we will introduce you to the various tax relief schemes offered by the inland revenue authority of singapore (iras). Tax offsets, also known as tax rebates, can reduce your taxable income if you meet certain eligibility requirements. Let's look at how cryptocurrency taxes work, why record keeping is essential, new 2022 tax brackets, and strategies you can use to reduce your tax liabilities.

Enroll in an employee stock purchasing program if you work for a publicly traded company, you may be eligible to. 2 days agotax loss harvesting: While in theory, these offsets could reduce your tax bill to zero, they.

Maximize contributions to your retirement plan. For instance, take a single worker whose taxable income this year is $40,000. One way to reduce taxable income is to maximize your registered retirement savings plan (rrsp) contribution each year.

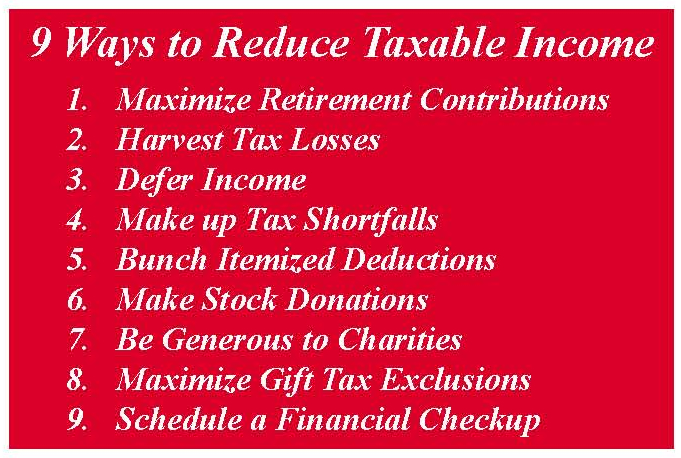

Here are 5 ways to reduce your taxable income 1. The money you put into your retirement fund isn’t taxable and,. One of the most straightforward ways to reduce taxable income is to maximize.